Join forces with a trusted fintech leader

We offer end-to-end financial infrastructure designed for Money Services Businesses (MSBs), fintechs, and global enterprises.

Built for Growth

Our platform is built to scale with your business—whether you’re an MSB expanding into new markets or a fintech startup launching a new service. We provide the infrastructure, regulatory alignment, and technical support so you can focus on what matters: building customer trust and accelerating growth.

Partner with us and access a modern financial operating system that powers global payments, FX, cash management, and regulatory compliance—all in one place.

MSB-Ready. Scalable. Compliant.

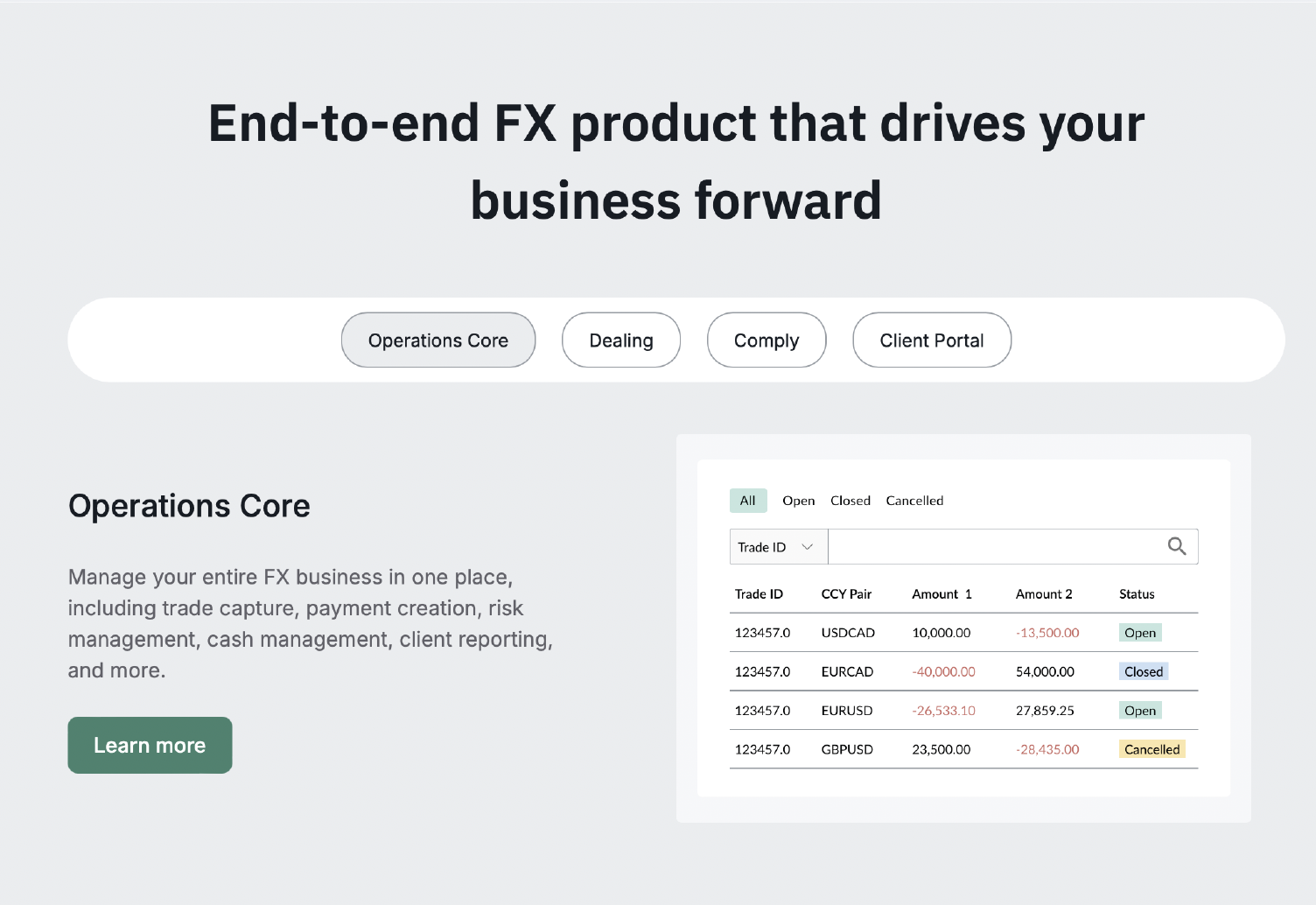

Whether you’re looking to launch your own FX service, streamline cross-border payments, or expand your product offering, we provide a fully integrated solution:

- White-label platform with your brand, our infrastructure

- Multi-currency accounts to hold, manage, and convert global funds

- Real-time FX trading tools across G10 and exotic currencies

- Treasury management dashboards for complete control and visibility

- End-to-end compliance covering AML, KYC, transaction monitoring, and reporting

- Seamless API integration and workflow automation

- 24/7 access to your financial ecosystem via secure cloud-based technology

Enabling startups and enterprises to operate like fintechs.

$500+ Billion

Annual FX Volume

$50+ Billion

Annual Payments

50% +

Avg. Efficiency Gains

Our all-in-one platform powers everything from FX trading and treasury management to white-label global payment solutions, giving you the tools to grow your business with confidence and compliance.

Compliance & Risk Management

At the core of our platform is a commitment to full regulatory compliance and risk mitigation—built to meet the demands of today’s complex financial ecosystem. We understand the regulatory pressure facing MSBs, fintechs, and financial institutions. That’s why we provide enterprise-grade compliance infrastructure as part of every solution we offer.

What We Offer

- End-to-End Compliance Framework

We support AML, KYC, KYB, transaction monitoring, sanction screening, and regulatory reporting. Our platform is built to adapt to global, regional, and country-specific requirements, ensuring you stay compliant wherever you operate. - Automated Onboarding & Verification

Seamless identity verification and business onboarding with built-in AML checks, risk scoring, and real-time decisioning tools. Reduce friction while staying protected. - Transaction Monitoring & Alerts

Intelligent rule-based monitoring flags suspicious activity and ensures adherence to AML and fraud prevention standards. Our system is designed for scalability, helping you manage risk as your transaction volumes grow. - Audit-Ready Reporting & Recordkeeping

Maintain full audit trails and generate compliant reports in a click—ready for regulators, partners, and internal governance. - Regulatory Expertise & Support

We work alongside your compliance teams and legal advisors to support licensing, program governance, and market expansion. We don’t just offer tools—we partner on compliance strategy.

By embedding compliance directly into our platform architecture, we enable our partners to scale with confidence—knowing they’re operating under the highest standards of integrity and oversight.

Join the FirmPayFX team

Take Charge of Your Future

At FirmPayFX, we’re redefining what it means to build a career in financial services. Whether you’re an experienced FX dealer ready for more freedom, or just starting out and eager to grow, we offer real opportunities with no ceiling on your potential.